Illinois Used Vehicle Tax . illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions.

from www.carsalerental.com

illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it.

How To Figure Sales Tax On A Car Car Sale and Rentals

Illinois Used Vehicle Tax if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private.

From stump.marypat.org

STUMP » Articles » Taxing Tuesday the Governor of Illinois Talks Taxes Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. as the owner of the vehicle, the lessor (leasing company) generally is liable. Illinois Used Vehicle Tax.

From www.templateroller.com

Sample Form RUT50 Fill Out, Sign Online and Download Printable PDF Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. illinois private party vehicle use tax is based on the purchase price (or fair. Illinois Used Vehicle Tax.

From www.signnow.com

Illinois 1040v 20202024 Form Fill Out and Sign Printable PDF Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. as the owner of the vehicle, the lessor (leasing company) generally is liable. Illinois Used Vehicle Tax.

From pannaindywidualna.blogspot.com

Illinois Used Car Sales Tax 2020 Gas Tax Rates By State 2020 State Illinois Used Vehicle Tax The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the. Illinois Used Vehicle Tax.

From www.template.net

Illinois Vehicle Bill of Sale Template Google Docs, Word, PDF Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of. Illinois Used Vehicle Tax.

From exohxanqx.blob.core.windows.net

Illinois Tax On Car Sale at Jacqualine Barney blog Illinois Used Vehicle Tax if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair. Illinois Used Vehicle Tax.

From www.carsalerental.com

Illinois Auto Sales Tax Used Car Car Sale and Rentals Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of. Illinois Used Vehicle Tax.

From cezrodos.blob.core.windows.net

Car Sales Tax Illinois Cook County at Christy Calvin blog Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it. illinois private party vehicle use tax is based on the purchase price (or fair. Illinois Used Vehicle Tax.

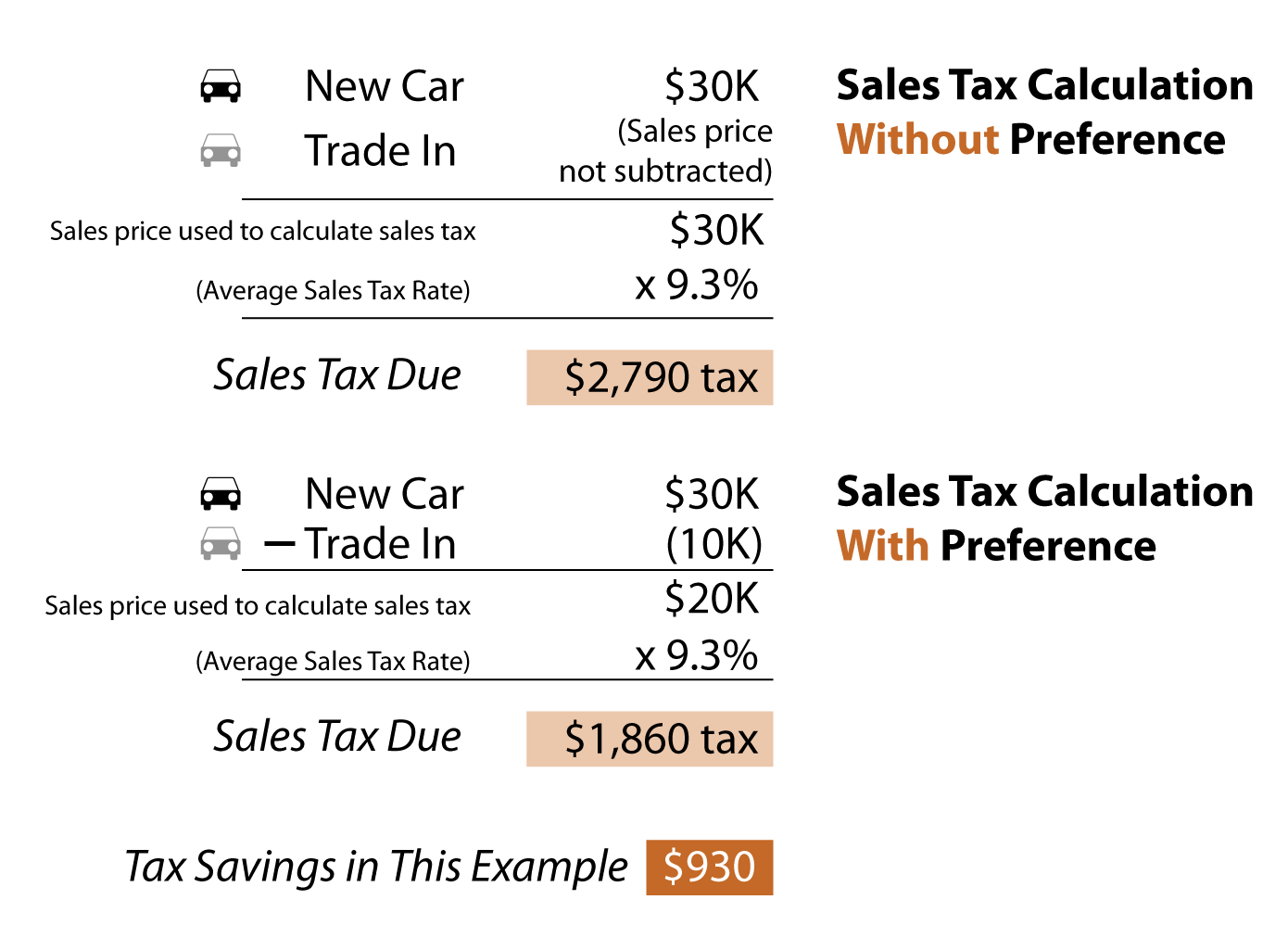

From www.illinoispolicy.org

Illinois House bills would reverse Pritzker’s car tradein tax Illinois Used Vehicle Tax if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the. Illinois Used Vehicle Tax.

From musterlehrer-0.netlify.app

Illinois Vehicle Bill Of Sale Template Fillable Pdf Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax. Illinois Used Vehicle Tax.

From www.uslegalforms.com

Vsd 190 20202022 Fill and Sign Printable Template Online US Legal Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. if you’ve recently purchased a used car in illinois, you owe sales tax—or use. Illinois Used Vehicle Tax.

From bill-of-sale.cocodoc.com

Free Vehicle Bill of Sale Forms in Illinois CocoDoc Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv. Illinois Used Vehicle Tax.

From www.templateroller.com

Download Instructions for Form RUT25X Amended Vehicle Use Tax Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when you register it. as the owner of the vehicle, the lessor (leasing company) generally is liable for. Illinois Used Vehicle Tax.

From www.carsalerental.com

What Is Illinois Sales Tax On A Car Car Sale and Rentals Illinois Used Vehicle Tax The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv. Illinois Used Vehicle Tax.

From mervintavares.blogspot.com

dupage county auto sales tax rate Mervin Tavares Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. illinois private party vehicle use tax is based on the purchase price (or fair. Illinois Used Vehicle Tax.

From www.heavyvehicletax.com

Form 2290 Heavy Vehicle Use Tax Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or. Illinois Used Vehicle Tax.

From www.carsalerental.com

Dmv Sales Tax On Used Car Car Sale and Rentals Illinois Used Vehicle Tax illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer). Illinois Used Vehicle Tax.

From exokessdc.blob.core.windows.net

Bloomington Il Vehicle Sales Tax at Jeffery Conner blog Illinois Used Vehicle Tax as the owner of the vehicle, the lessor (leasing company) generally is liable for illinois use tax and responsible for filing. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. if you’ve recently purchased a used car in illinois, you owe sales tax—or use tax—to the dmv when. Illinois Used Vehicle Tax.